Archive for category Taxes

Are Electric Cars Really Green?

Posted by dblakelock in Government, Politics, Taxes on March 10, 2016

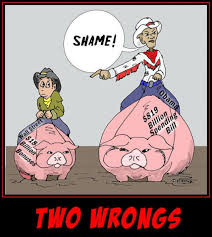

Look in the Mirror

Posted by dblakelock in Government, Politics, Stimulus, Taxes on July 16, 2014

This column will be published on the eve of the annual Update Banquet, a weekend of education and camaraderie. A chance to reconnect with old and new friends and to discuss the issues that are near and dear to our hearts. Once again family obligations keep me from coming to my second favorite city to join in the festivities. But that doesn’t mean I can’t join in the conversation.

As many of you gather to discuss the big issues there is an ongoing debate within the Republican Party as to whether it is the party of business or the party of free enterprise. To a Democrat they are the same thing. To those who think at all about the issues they are very different.

The debate today centers around the reauthorization of the Export Import Bank. It has become a litmus test of whether you are for or against crony capitalism and now many members of congress (even some Democrats) are wrapping themselves in that vote to show how pure they are. How they are for the little guy. Well unless you work for Boeing it’s not that difficult to be against the Ex Im Bank.

But after taking that easy position the hard questions start. It’s important to look in the mirror and ask if we really are the party of free enterprise or the party of big business. It’s easy to be against the things that don’t effect you, but where do you stand when you or someone close to you gets a direct or indirect benefit from a government program. And let’s be honest, with a government that spends and regulates as much as ours does we are all touched by it one way or another. So are you willing to gore your own ox? This is a list that I crafted in a few short minutes but with a little effort I could go much broader and deeper. I will only comment on a few of the items. We each need to be asking ourselves, what are we willing to give up?

Direct Spending

Education Funding – 12 % of all direct education spending is funneled through the Department of Education. They don’t create the wealth, they just take if from us, take a cut and send it back and yet we feel good about this.

Farm Bill – The farm bill is $956 Billion over 10 years. $756 Billion goes to food stamps, $90 Billion to Crop Insurance, $56 Billion to Conservation, $44 Billion to Commodity Programs (price supports) and $8 Billion to everything else.

College Aid and Loans

Green Energy Investments

Transportation Bill – It’s not that I am opposed to roads but does the money need to flow through Washington and back to the states. Should someone in Arizona really have helped pay for the “Big Dig” here in Boston?

BRAND USA – $100 mm annual direct spending to support tourism in the United States.

Tax Deductions

Home Mortgage Interest – One of the most controversial items on this list. We have all been brought up that owning a house is important to society and that home interest should be deductible. How much of the real estate crash was because of this mindset. Canada has an equal percentage of home ownership without the subsidy.

Charitable Contributions

Tax Free Muni Bonds

Special treatment of Carried Interest – When an investment firm (PE or Hedge typically) receives a payment of carried interest it is taxed at the lower capital gains rate. This isn’t typical capital gains because there is no money at risk. It is more of a bonus payment based on performance.

Special Treatment of Oil and Gas Depletion Allowance – Oil and Gas companies get to take a depletion allowance (think depreciation) based on how much oil or gas they initially believe is in the well. Then can then continue to take this allowance well past 100% as more oil or gas is discovered in the well.

Regulations or Administrative Actions

Anti Online Casinos Legislation – Shelly Adelson, a big donor to Republican candidates and causes is also the biggest proponent of keeping online gambling illegal. Not because he is against gambling but he doesn’t want competition for all of his casinos.

Ethanol Blending requirements

Zero Interest Rates from the Fed – The fed allowing banks and other financial services firms to borrow at close to zero interest rates is essentially providing a subsidy to them while discouraging saving in society.

Insurance Mandates – Insurance mandates provide demand for things like contraception, chiropractic and other services because someone else is paying for them. If you lobby enough you can get on the list.

ObamaCare

Licensing Requirements – Licensing for hair stylists and taxi cabs and nail salons only limits competition and benefits the owners of the businesses.

USDA and FDA Regulations –

So have I pissed everyone at the banquet off a little or am I being burned in effigy? If so, I have done my job.

Many of these we could all agree on, but can we all agree that a simpler tax and regulatory environment is better for the country even if it means that our personal ox is gored? What are you willing to give up?

——————————————-

Farm Bill

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/01/28/the-950-billion-farm-bill-in-one-chart/

Absurd IRS Code Observation Project (AIRSCOP) – Feb 23, 2014

Posted by dblakelock in Politics, Taxes on February 23, 2014

When figuring out an individual’s deductions they add one for each filer and then if any of the filers are over 65 you get another standard deduction. Why does this make sense? The over 65 cohort has the highest median wealth of any age group. Why are we using the tax code to subsidize the wealthiest age cohort in the country?

Absurd IRS Code Observation Project (AIRSCOP) – Feb 22, 2014

Posted by dblakelock in Taxes on February 22, 2014

If you were born on Jan 1, 1993 and I asked you how old you were for the 2013 tax year you would probably tell me that you were 19 because you turned 20 in 2014. But only in the strange world of the IRS does the calendar turn over on January 2 instead of January 1.

AIRSCOP – Feb 28, 2014

Posted by dblakelock in Government, Politics, Taxes on February 21, 2014

That the tax code is used to try and redistribute wealth is unquestionable. The varying levels of effectiveness is something that is very rarely studied and could be debated long and hard.

One item is the “Work Opportunity Tax Credit”. This gives 40% of the first $6,000 of earnings as a tax credit to the employer. The Employee must meet a number of criteria. They must work at least 400 hours and must be deemed eligible based on being a “qualified” member of a family receiving Temporary Assistance for Needy Families, food stamp recipients, veterans, ex-felons, residents of empowerment zones or enterprise communities, vocational rehabilitation referrals and summer youth employees.

How the employer determines if someone is eligible and the paperwork to document their eligibility must be a nightmare and for what? The Inspector General of the Labor Department concluded that the program simply provided federal funds to employers who would have hired the employees anyway. So why does it still exist?

Absurd IRS Code Observation Project (AirsCop)

Posted by dblakelock in Taxes on February 19, 2014

25 years ago when I first graduated from business school it was a point of pride for me to do my own taxes. My taxes were pretty straight forward and I had the naïve belief that every American should be able to do their own taxes.

That lasted about 10 years and as I got busier with work, kids and a house and as my frustration level grew at the ridiculousness of the tax code my wife convinced me to hire someone. When I was doing them it was crazy there would be 2 or 3 weekends in March and April when I would just be unpleasant to be around and she didn’t want that anymore.

That lasted until last year. I looked at our bill for tax preparation and said “$3,000! For what!?!?!” I was thinking this is just crazy. We do everything to keep our taxes simple. One problem is in spite of an MBA in Finance and Accounting, I am intimidated by the IRS. When I file there is always a nagging voice in my head saying “are you SURE that you did that right?!?!?” When I see an envelope with the IRS as a return address I break out in a cold sweat. Yes, my name is Dave and I am afraid of my own government.

So, I decided to do something about it. After doing my taxes last year and feeling uncomfortable, I signed up for a Tax Law class to get more comfortable for this year. So, for 15 Tuesdays from 4 – 6:20 I am studying Tax Law.

In anticipation of the first class I went out to get my textbooks. The Tax Case book is 1400 pages of the smallest most dense type that you want to see (hey, I have 52 year old eyes – these things matter). Then I go buy the actual IRS tax code – 5,000 pages of even smaller denser type. Ugh.

And then the absurdity begins. On page 2 of the case book I read “Three tax policy evaluation standards traditionally have been employed in choosing among and implementing possible objectives for a tax system (and the objectives are not mutually exclusive): equity, efficiency and simplicity.”

Equity, efficiency and simplicity! If only that were true. That is the one sane thing that I have heard in this class and it isn’t even true. I have now been down the rabbit hole for 5 weeks and every week when I come home from class my wife asks how it was. My only response is that it is ridiculous and infuriating that we have developed a system that is so complicated that no one can be expected to be able to do their own taxes without the help of a computer. I think of someone with a high school education making $40,000 who doesn’t have a chance of understanding what they are doing. I think of my sister, a college graduate who would probably be considered lower middle class. Most of the code is geared towards helping people like her but even though she is smart, there is no way she is going to be able to do her taxes correctly and take advantage of the code with out help. And that just isn’t right. Every Citizen should be able to do their own taxes yet only 10 percent do. (National Taxpayer Advocate estimates that 60% of filers hire someone and 30% use software). That isn’t right.

As technology has progressed to make it simpler for the average citizen to do their taxes (you’ve all seen the commercials for TurboTax, TaxAct or H&R Block), our tax system has become a black box that nobody understands. Congress is constantly tweaking the system to try and get us to do what they want us to do. (Try googling – “how many tax changes for 2013” and you will get 657,000,000 results – yes that’s 657 million.)

But if no one understands what is happening in the box how can we modify our behavior the way that Congress wants us to? We can’t. What I have discovered is congress is writing headlines with one hand and taking them away with the other. The headline is “get tax credit for…” but when you peel back the layers you find out that you don’t qualify because you make too much money, or you don’t spend enough on child care, or you aren’t in the hurricane Katrina zone or you aren’t an American Indian. Yes, all these things happen.

I have decided that in order to survive this class and as a cathartic action I need to get these absurdities out of my system. So, everyday for the next year I am going to write about one absurd fact of the IRS Code. It may be a quick fact that I find crazy or it may be more detailed like how you calculate the Social Security Exclusion. If you are interested, you can follow my pain at my personal blog:

https://engineeredsuccess.wordpress.com

and maybe occasionally I will update you all here at “The Update”.

Wish me luck. And good luck with your taxes this year.